Disintermediating Network Effects for Fun and Profit

People who get good at the game, capture the game

It’s a story as old as time. History itself is based on this principle — the winners decide what happened.

It’s everywhere, which makes it hard to spot. But there are enough examples for an entire book, so here are a few:

- The USDA taught a lie in the 90s when they told millions of Americans to eat using a Food Pyramid created by big business.

- The legal system and tax code favor people who can afford it. Laws are regularly created for the highest bidder. Gerrymandering is the norm.

- Sinclair Broadcast Group owns most local American TV stations and push Black Mirror-Esque propaganda.

- Richard Nixon, The Man Who Sold The World, hijacked the money supply in 1971 when it stopped being backed by gold (free-market money). WTF Happened In 1971? shows the split we’re all feeling today.

- Homeowners regularly capture an area, like NIMBY (Not in my back yard) vs. YIMBY (Yes in my back yard) in San Francisco. If homeowners don’t capture an area, homeowner associations do — often hijacked by an intolerant minority.

- Peer Review has been captured. Stephen Wolfram is working on a physics project he’s taking directly to the people. “I don’t really believe in anonymous peer review. I think it’s corrupt… I think it’s sort of inevitable that happens with these very large systems.”

Humans are clever and will find a way to optimize any game.

There are two ways to handle problems like these — better incentives and culture.

At scale, solving these problems with culture looks like cancel culture — it increases the standard deviation of society.

Meanwhile, better incentives are a fog of war, but every once in a while there’s a breakthrough.

Network Effects are Natural

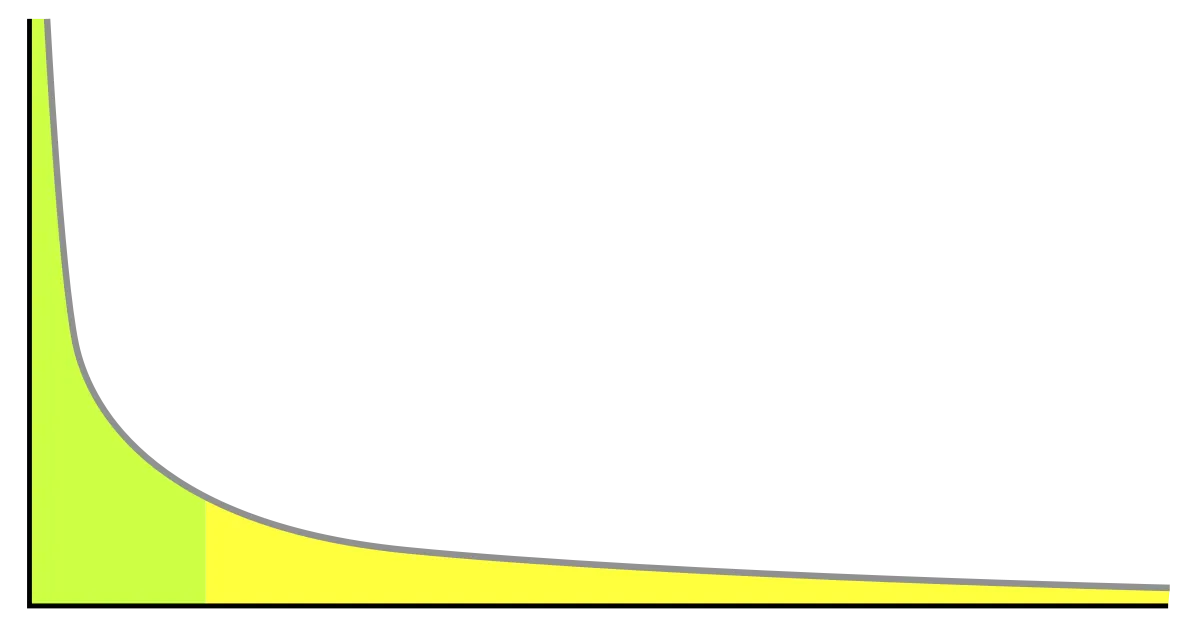

Pareto distributions are when a small number of parties end up with most of the resources. You don’t need human greed to get a concentration of wealth (it helps though).

If two trees start at the same height but one receives slightly more sunlight, it will grow a little faster. Over time it grows higher, receiving even more sunlight—while casting its shade on the other tree, stunting its growth. 80/20, a Pareto distribution.

Wealth and power concentrate, which is why people capture games. This is true in a normal economic environment, but in one where the captured money supply is inflating asset prices for equity and creating stagnant wages for labor — it supercharges the disparity. This is why the middle class in America is disappearing. Now you’re either rich or poor.

Tech concentrates wealth and power even further.

Because the marginal cost of information is zero — it tends towards free. And because some networks are best when really big, like social networks, they tend towards winner-take-all.

When a service improves the more people that use it; that’s called a network effect. Some businesses are destined to be huge because of their network effects, like Facebook.

When someone wins a market with network effects, they capture it — it’s good capitalism, after all. A sustainable competitive advantage allows a business to extract profits for a long time.

“Competition is for losers” — Peter Thiel

The problem is when capitalism itself gets captured and creates an uneven playing field for everyone. Even free-market economists like Hayek believed fair conditions were necessary to sustain competition.

Whoever controls the lowest layer controls the higher layers.

In an increasingly digital world, the owners of the networks control everything, even things like whether The President of the United States can communicate in the town square.

Cracks in the Foundation

People underestimate how quickly the rules can change.

The printing press changed the rules by changing the cost of distributing information. So did the Internet. Arab Spring. American Spring. American Fall.

Bitcoin did something a little different — it created a network that could sustain itself.

Which meant, in theory, that people could use Bitcoin as the network instead of Facebook, Google, etc…

And because it’s self-sustaining, it would solve the problem of who owns the lowest layer of society — nobody/we all do.

In other words: everybody would have a level playing field, and people wouldn’t have to trust each other; they could trust the system — Social Scalability as Szabo says.

Why in theory? Because it didn’t work out that way.

Bitcoin split into the stakeholder forks: users, businesses, and miners.

Forking can be helpful in the same way divorce can be helpful. Every time a network forks, it destroys value. Metcalfe’s Law says the network effect is the number of participants squared. So a 100% network that forks into two halves doesn’t split to 50% and 50% — it splits to 25% and 25%. 50% of the network effect gets destroyed by forking. Imagine a small town that forks into two phone networks that can’t talk to each other. Everybody is worse off—so hopefully, the fork was for a good reason.

Bitcoin would be a very different beast if it had never forked, but each stakeholder (users, businesses, and miners) wanted something different from the system.

Bitcoin (BTC) is a volunteer network supported by users, so it can’t scale. As soon as it does, the game becomes economic, and everything collapses. BTC Core developer Peter Todd recommends a permanent 1% inflation to offset the falling block reward, but that means touching the third rail of Bitcoin — changing the 21 million coins.

Bitcoin Cash (BCH) is a network supported by businesses, which is why they tried to add a 12.5% block reward tax to pay for development and ended up forking off eCash. Miners are not paying for infrastructure, and they’re capturing it when they do.

“… an ‘infrastructure funding plan’ that would see miners donate 12.5 percent of all block rewards to a Hong Kong entity…”

Bitcoin SV (BSV) is a network supported by miners, which is why they’re privatizing the p2p network and why it’s leading to problems:

“Unfortunately this has come at considerable cost in our ability to reliably transact to chain.”

The Lightning Network does not solve the problem either. Higher layers are not immune from base layer rot, and the routing network is heading towards centralized solutions — essentially PayPal.

Binance Smart Chain (BSC) validators are having trouble keeping in sync with the network because the incentive problems are not solved; from a frustrated GitHub issue, BSC is a lost cause:

“Roughly a year ago I was able to run bsc … nodes on literally some of the cheapest VPS’s (<$20/mo) I could find with relatively decent specs… Now I’m paying thousands a month for dedicated hardware just to keep my infra[structure] running smoothly.”

The biggest competitor to Bitcoin, Ethereum (ETH), has a similar problem — The Infura Problem.

From The Architecture of a Web 3.0 application:

“Setting up a new Ethereum node on your own server can take days…

Cost of storing the full Ethereum blockchain goes up as your DApp scales…

As your infrastructure becomes more complex, you’ll need full-time DevOps engineers…

Avoiding these headaches is why many DApps choose to use services like Infura or Alchemy to manage their node infrastructure for them.

Of course, there’s a trade-off since this creates a centralized chokepoint…”

These are the hidden reasons why blockchains get captured.

A blockchain is a public good that must be self-sustaining—if it’s not, it destroys the openness and trustlessness needed to use it.

Other blockchains, naively, see the free-market solving network infrastructure as a feature rather than a bug:

“The job of miners is to secure the network via hashpower, not to provide network infrastructure.” — Vitalik Buterin

Bitcoin Maximalists argue, “Every problem with Bitcoin can be solved with Bitcoin.” That sounds great, but it isn’t true.

Privatizing network infrastructure destroys blockchains.

Despite the good intentions of many blockchain projects, many of them have already been captured, and the participants are in denial because they believe the market will sort it out.

To learn why this isn’t the case, here’s David Lancashire telling Vitalik Buterin about blockchains and public goods:

“Read Mancur Olson to understand what [your problems] actually are; he explains why all solutions to funding public goods (i.e., your network) that do not align your mismatched incentives on that layer require closure, cartelization and monopolization.”

The market sorting it out requires blockchains to break openness and trust.

For decades, the market has been sorting it out in tech, and it’s clear where it leads.

This is how Mark Zuckerburg ends up owning the Metaverse.

Meet the new boss, same as the old boss

Nassim Taleb teaches Localism — as the scale of something gets bigger, what that thing is, actually changes. This is undoubtedly true of consensus mechanisms.

On a small scale between you and your partner, there is a lot of trust, and as you scale up to your family, friends, coworkers, peers, city, state, country, and world — the trust starts to evaporate.

Which is why you don’t charge your family to access your fridge, but you might your roommate.

And it’s why consensus at the highest levels (“Globalism”) should require the least amount of trust, because otherwise it’s tyranny.

When we can all trust the same global system, and that system is a public good, and we don’t need to politicize parts of the process that typically get hijacked — Social Scalability remains intact. Humanity gets to level up because it can work at a higher level of abstraction. This leveling up is what Organizations 2.0 is all about:

“Allowing humans to level up their leaky abstractions for interacting with each other in large groups is one giant leap for mankind.” —Organizations 2.0

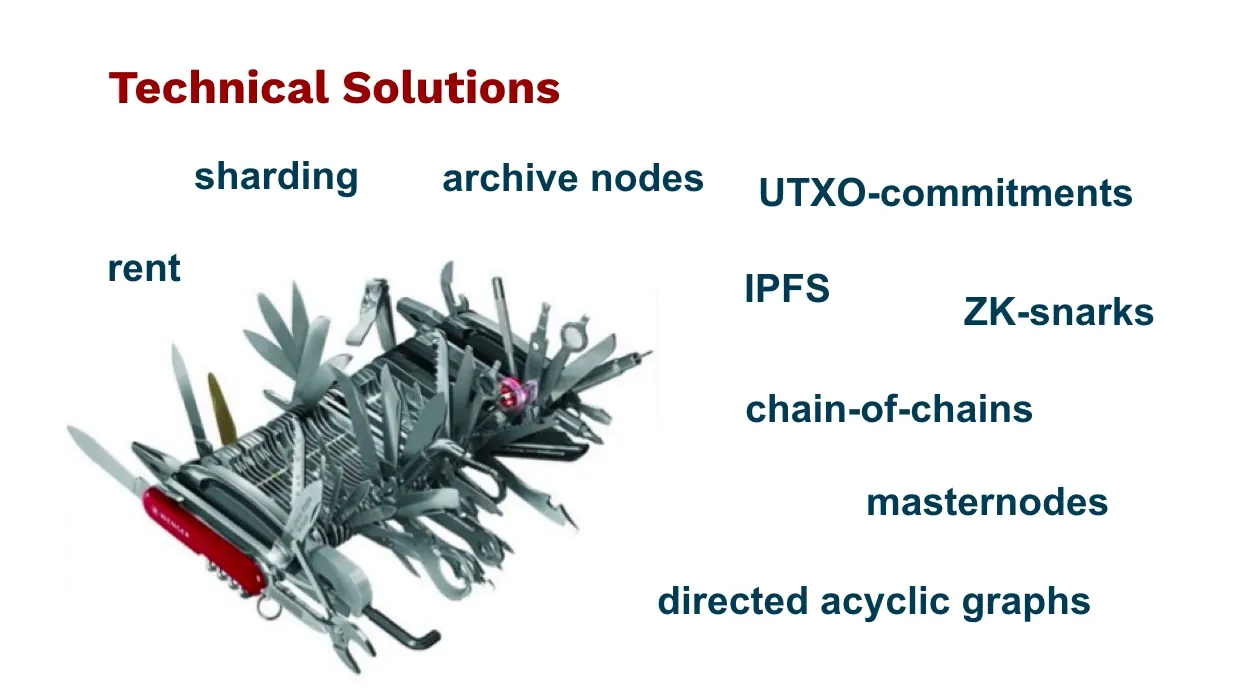

But your favorite blockchain has to invent dozens of technical solutions that fundamentally don’t work because the underlying incentives are broken.

All these complex technical solutions just mean as the blockchain gets big, there are more ways to capture it.

The only way to solve this problem is to fix the incentives.

The focus on technical solutions over incentive solutions is why blockchains are getting captured, and it’s why Web2 got captured.

As a “network of networks,” the Internet was supposed to disintermediate network effects, but the opposite happened — it took out newspapers and created Super Aggregators and Surveillance Capitalism instead.

Here’s Andrew Schulz realizing the game being played.

Andrew Schulz: Record labels back in the day would pay the DJs and stations … to play their records…

The only way an artist could get radio play is if they had a label…

Internet Music comes out, fair game for everybody again

Streaming platforms pop up, now all of a sudden — at first it was fair game for everyone — but now it looks like they’re bumping certain musicians.

Now we’re back into the record label model, that we thought we just broke.

Akaash Singh: Yeah, the new empires are going to look a lot like the old ones

— Flagrant 2 (NSFW: language)

The Logic of Collective Action

These networks are collective action problems in hiding.

Large collective action problems are so challenging to solve because at scale cooperation breaks down, but in the last decade, there have been at least three breakthroughs:

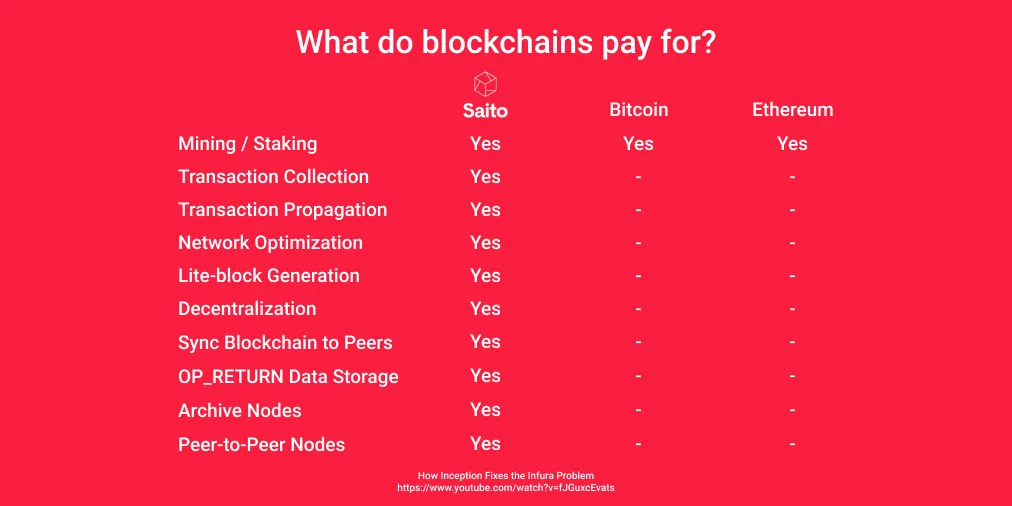

- Bitcoin found a new solution to The Byzantine Generals Problem, making it economic, allowing it to be open and leaderless.

- Saito solved The Tragedy of the Commons with a Circular Ledger and Automatic Transaction Rebroadcasting (ATB), allowing data to be pruned and long-term on-chain data storage to be subject to market forces.

- Saito solved The Free Rider problem with Routing Work, finding a way to fold “paying people for valuable work” into the openness, security, and consensus of the network.

Bitcoin showed it was possible to coordinate without a leader in hostile environments.

Saito showed it was possible to have a self-sustaining public good.

These are economic breakthroughs with incredible social implications.

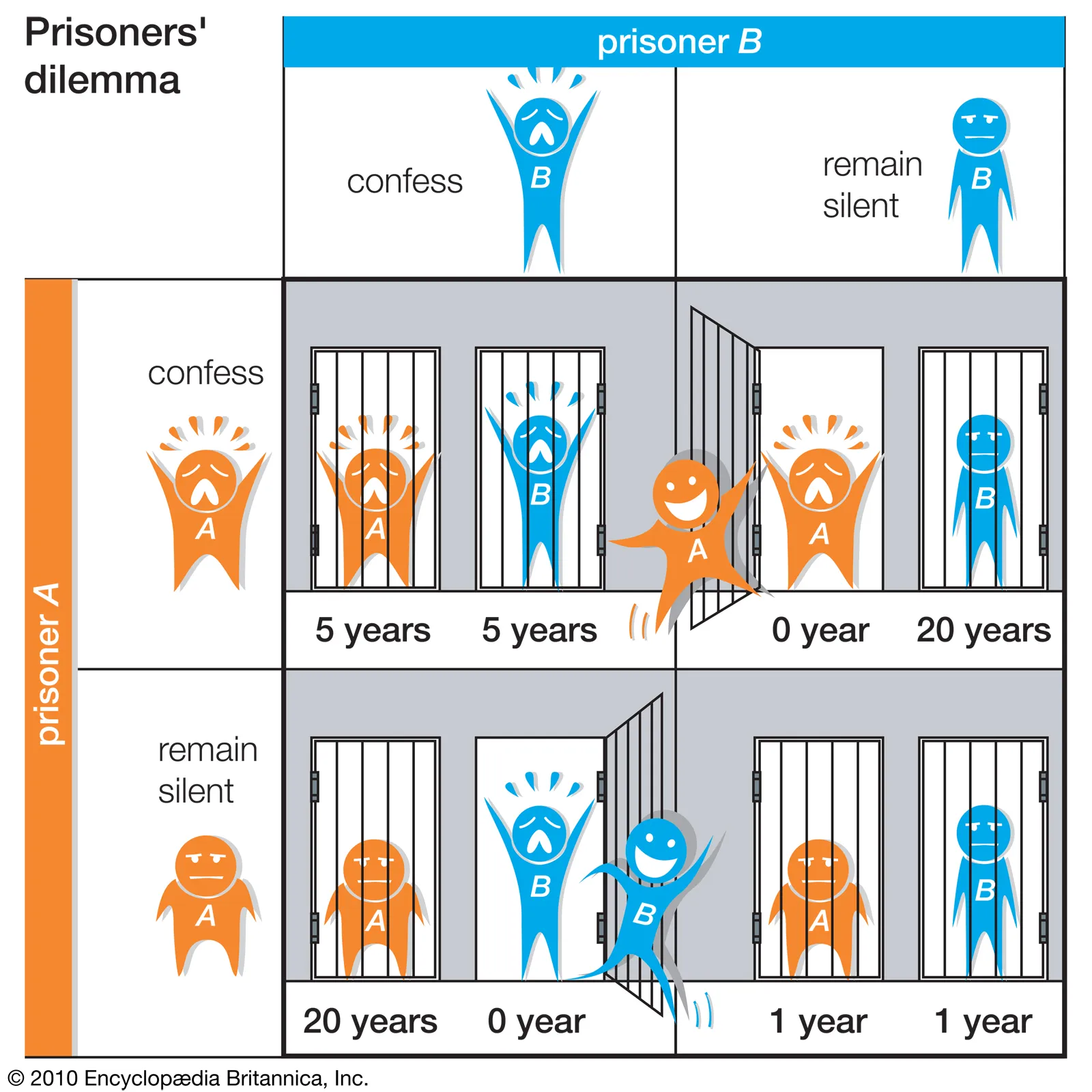

The best way to understand collective action is through the lens of game theory. It can be challenging to understand at first, but once you do, you’ll see it everywhere and be able to understand how incentives influence behavior.

The Prisoner’s Dilemma is the classic game theory example that describes two people who are not incentivized to work together — two prisoners being interrogated separately by police. They’re both better off if they both remain silent, but they’re individually incentivized to confess. But if they both confess, they’re both worse off — that’s the dilemma.

Golden Balls is a game show with a segment called Split or Steal that modifies The Prisoner's Dilemma by letting “the prisoners” talk to each other. Somebody uses it for dramatic effect, shifting the game theory by behaving “irrationally.” Watch this clip and try to figure out if the strategy is a good one—it's well worth the 6-minutes if you haven’t seen it yet.

Player A: I know that I’m a decent guy and will split the money with you.

Player B: We’ll we should just both split then.

Player A: No, I’m going to do steal.

Game Theory, Economics, and Incentives are at the heart of building better systems at a global scale — not software, technical solutions, governance, or committees.

Anything that requires volunteers or allows cartels and monopolies isn’t going to work. And anything that isn’t open and self-sustaining will devolve into the former.

The incentives have to be right “all the way up” as the blockchain scales; otherwise, it will get captured.

“Saito did What Bitcoin Did; they found a way to convert collective action problems into economic problems — and then solved them with the free market. By doing so, they created a self-sustaining system that is open, leaderless, and doesn’t degrade over time…

Nakamoto Consensus enables organizations to be open and leaderless. Saito Consensus lets them stay that way.”

Saito Consensus is an elegant solution to an incredibly tricky problem and the kind that allows us to build better systems at a global scale.

Distribution Rules Everything Around Me

The layers of the stack matter, the further down the stack, the more they matter. Having a stable layer one blockchain that’s scalable and self-sustaining is critical to the integrity of everything built above it.

As you go up the stack—the second and third layers—the protocol and application layers, are also essential to get right.

Most people think putting data on-chain is enough to disintermediate network effects, but it’s not. The network effects are arguably more important than the data itself.

Here’s a thought experiment: would you rather lose your email archive or the ability to email your contacts?

Many businesses could lose their email archive without breaking a sweat, but they’d go out of business if they lost the ability to email their list.

Simply switching email providers or backing up emails is not what makes it decentralized (though it helps). Being able to own an email list and communicate with it from anywhere makes it decentralized.

The reality is email, from Web1, is more decentralized than most Web3 applications.

Businesses like OpenSea are decentralized in the sense they use NFTs, which can be sent around from wallet to wallet. But the liquidity of buyers ends up being a critical centralizing factor: a network effect.

Like Facebook, these networks get large, and distribution becomes the primary feature—almost nothing else matters (see Craigslist).

Tokens are seen as a solution, but they don’t always make something more interoperable — sometimes the opposite, they can provide lock-in, as this VC explores.

But OpenSea doesn’t have a token, so ‘tokens are good’ or ‘tokens are bad’ isn’t the right lens. What matters is, can someone capture the network?

If so, we’re just playing the same games we’ve always been playing. To play new games, we have to do things differently.

Web3 protocol designers view their work as technical—but they should increasingly view it as economic because they’re designing incentive systems.

Protocol designers are closer to financial hackers—the kind that would find loopholes in pudding rewards or lottery tickets. These are economic bugs that let people cheat the system, and exactly the kind of problems protocol designers aim to fix.

How to Disintermediate Network Effects

What can designers do to build protocols resistant to capture?

1. Open, Leaderless and Self-Sustaining

These qualities are the gold standard of Web3 protocol design—Organizations 2.0 explains in detail how they level up human cooperation and competition.

2. Plan for Competition

People love their coffee shops but hate their cable companies. One has a lot of competition; the other has none.

Competition is bad for the player but good for the game.

3. Free Markets vs Public Goods

In networks and protocols — competition usually gets diminished because somebody captures it.

It’s tempting to push everything to the free market — but the parts that have social qualities (like being open, leaderless, self-sustaining) make them public goods.

If you push public good problems to the free market, your protocol won’t remain open and leaderless for long.

Public good problems must be solved in a self-sustaining way. Look to Saito Consensus to understand how they solved the tragedy of the commons and free-rider problems every other blockchain has to solve.

4. Let people leave

The book “Exit, Voice, and Loyalty” explains two ways people deal with problems in an organization: they voice their concerns or they leave.

Often when they leave, they may go to a competitor.

While people leaving can hurt, the alternative is unethical—forcing someone to stay when they don’t want to.

All the best things in life are voluntary, but companies regularly lock in customers so they can’t easily leave. It’s short-sighted and only works because they can get away with it, for now.

Open networks cannot easily be controlled—and doing so will mark you as a potential bad actor. Crypto has evolved the phrase “not your keys, not your crypto” for this reason—implying, if you don’t have your keys, you can get locked in—be careful!

5. Open-source is a superpower

Bitcoin couldn’t exist without being open-source.

Because it’s open-source, the free market governs it through hard forks—making it antifragile. Bitcoin was top-down designed, but evolutionary forces from being open-source and forking converted it into a bottom-up design.

To the confusion of ideologues everywhere—blockchains being a new kind of public good, enable a new kind of free market.

6. You won’t have a chance to download your data

If a “trusted” 3rd party has your data and you lose access, you won’t have a chance to get it back.

Putting data on-chain is the best defense against de-platforming. Off-chain data sounds great but has many problems.

7. It’s the Network Effect

Saving user data is good, but saving the network effect is better.

Just like email, losing your archive is bad. Losing the ability to contact people is worse.

Designing open protocols means building networks where the network effect is either decentralized (like an AMM liquidity pool token) or designed so that a single company owning a large percentage of the user experience (like Gmail) can’t capture the distribution.

8. Entirely P2P won’t work

People don’t want to run servers. It’s okay for markets to specialize and service providers to receive economies of scale.

Email is a decentralized protocol, and customer behavior shows people just want to click and have things work, like Gmail.

What’s important is ensuring protocols stay competitive.

Federated servers following a decentralized blockchain with layers of competitive protocols for storing data, with semi-interoperable apps built on top, seem like a pretty workable solution.

Forcing everything P2P will be painful; there’s a reason the Cloud exists. Offline apps are great, and P2P app architecture is great, but expecting users to run P2P nodes is a losing battle. Some power users and volunteers will run nodes, but most will use a 3rd party. It’s better to accept this reality, minimize trust and make it competitive as possible.

9. Privacy isn’t perfect

Ethereum uses a single address, that if anybody finds it, exposes your entire wallet history. Twitter is public.

People are okay with some things being public, and public data is a great way to disintermediate specific network effects (like a follower graph).

But privacy is still important. What needs to be private can be shielded using multiple addresses, like described in the Bitcoin Whitepaper. And data can be encrypted, with techniques like zero-knowledge proofs used to keep privacy.

10. Put signed user data on-chain

Signing data with user keys is an effective way to build dapps—it treats a user’s history as a state machine and processes all the actions from the user on the blockchain to make the current state.

It’s also good practice to sign user data when storing it off-chain, but as mentioned runs the risk of lock-in and de-platforming. It’s worth noting higher layers may offer a decent tradeoff between the extremes of on-chain and off-chain data.

11. Freeze protocols over time

Protocol development requires bug fixes and, more realistically, new features to stay competitive—but changing things is inherently centralizing.

A good tradeoff is to freeze protocols over time, so they change less and less—giving confidence that protocols become stable while still being flexible to adapt short-term.

12. Beware Embrace, Extend, Extinguish

Big companies love to gain distribution from open protocols by embracing the project, then extending them in proprietary extensions that extinguish innovation. Embrace-extend-extinguish is pacing and leading with malicious intent 101.

Microsoft did it with Internet Explorer; Google’s doing it with Chrome; Amazon with AWS.

Make sure they don’t do it to your favorite blockchain or protocol. Embrace-extend-extinguish is tricky because it looks like adoption, and it feels good to get validated from big organizations. Just be careful, don’t get Zuckerpunched.

13. Software Licenses as a Defense

Crypto likes to pretend law doesn’t matter, but it does, and to that extent, software licenses matter.

Pirates will abuse software licenses, but businesses (typically) won’t—it’s not worth it to build their castle on sand.

Software licenses can be a project’s best defense against large organizations trying to piggyback on their network effects (to embrace-extend-extinguish them).

For example, many tech startups with open-source products adopt a “non-hosting” clause, stating that you cannot offer a paid hosted version for X years. This clause prevents companies like Amazon from implementing the startup's hard work into AWS.

Startups are trying to get distribution faster than incumbents can get innovation. For open-source projects, software licenses are a critical tool in this fight.

How the Web Was Won

Web1 was open and idealistic; that idealism got taken advantage of in Web2 by private companies capturing network effects and putting up walls.

Web3 is an opportunity to take back the Web, but only by fixing the incentives rather than fixing the tech.

Web3 can be different from Web1 and Web2 because Nakamoto Consensus and Saito Consensus enable new ways to cooperate.

[Nakamoto Consensus and Saito Consensus] enable blockchains, but more fundamentally, they represent a new way for humans to organize.

By converting long-standing collective action problems into self-sustaining economic networks, they’re innovating age-old problems that prevent large-scale collaboration — enabling cooperative behaviors at a level never seen before.”

Today, we all live in digital company towns; corporations own everything and we buy from them. Tomorrow, we’ll live in digital metropolises that we own, with a real economy—10,000x the scale of today. A new digital frontier.

Software eats the world.

Disintermediating Network effects for fun means standing on the shoulders of giants to gain superpowers and blast through complex collective action problems that have existed since the dawn of civilization.

Disintermediating Network effects for profit means playing modern-day Robin Hood, unbundling the rent-seeking corporations of yesterday into tomorrow’s networks of the people, by the people, for the people.

“You musn’t be afraid to dream a little bigger darling” — Inception